will child tax credit payments continue into 2022

However Congress had to vote to extend the payments past 2021. 1 day agoPrices are soaring and employment among those receiving monthly child tax credit payments declined by 41 after the monthly credit expired.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

However the GetCTC portal will not reopen.

. Therefore child tax credit payments will NOT continue in 2022. The final advanced child tax credit payment for 2021 will be issued in two weeks time as congress still debates whether to continue the program in 2022. The final child tax credit payment of 2021 hits accounts this week.

15 Democratic leaders in Congress are working to extend the benefit into 2022. Letter 6419 includes the total amount of advance child tax credit payments. Tweaking the legislation to shore up votes like Manchins could delay passage into the new year meaning families may start 2022 without a firm plan for child tax credit installments in place.

Now even before those monthly child tax credit advances run out the final two payments come on Nov. The letters will continue being sent out into January. Office of Governor Ned Lamont.

Heres what to expect from the IRS in 2022. In order to claim money using the portal families would have to fill out a form online. This expanded child credit is in effect for 2021 and 2022 and it expires at the end of 2025.

No monthly CTC. Theres a plan to extend the credit but politics is getting in the way. The purpose of the portal is that it is free to use and doesnt require tax documents.

Families are making awful compromises every day. As it stands right now payments will not continue into 2022. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. Last March Congress added a second expansion of the credit just for 2021 as part of its pandemic response. However if the Build Back Better act passes the Senate it would.

Families who received advance payments will need to file a 2021 tax return and compare the advance child tax credit payments they received in 2021 with the amount of the CTC they can properly claim on their 2021 tax return. The way it looks right now the increased child tax credits wont be continuing into 2022. However if the Build Back Better act passes the Senate it would extend the.

Many are hoping that the child tax credit payments could extend until 2025. Most payments are being made by direct deposit. The pay increase is equivalent to over 45000 per year for a full-time worker.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. However if Congress doesnt approve President Bidens proposed modifications as part of the Build Back Better plan the program will revert to its original form. This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than 36million families across the country.

As it stands right now payments will not continue into 2022. The eligibility requirements would be the same as the 2021 expanded child tax credit. Washington lawmakers may still revisit expanding the child tax credit.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Ad The new advance Child Tax Credit is based on your previously filed tax return. In total it would cover 35 million householdsor 90 of those with children.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022. The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec.

So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6. By the end of this year families will have received. The Child Tax Credit in 2022 isnt going away per se.

Making the credit fully refundable. The advance is 50 of your child tax credit with the rest claimed on next years return. If you previously received the Child Tax Credit reduced or disallowed by the IRS and havent filed Form 8862 you may not.

Bank of America plans to continue raise the minmum it pays employees to. Child tax credit payments will continue to go out in 2022. Families need to know that critical programs like the child tax credit will continue uninterrupted Schumer told the Senate Monday.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. The 2022 Connecticut Child Tax Rebate was created as part of the fiscal year 2023 budget adjustment bill that was signed into law by Governor Lamont. Child tax credit payments continue in 2022.

That budget includes more than 600 million in tax cuts amounting to the largest tax reduction in Connecticuts history. This credit begins to phase down to 2000 per child once.

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

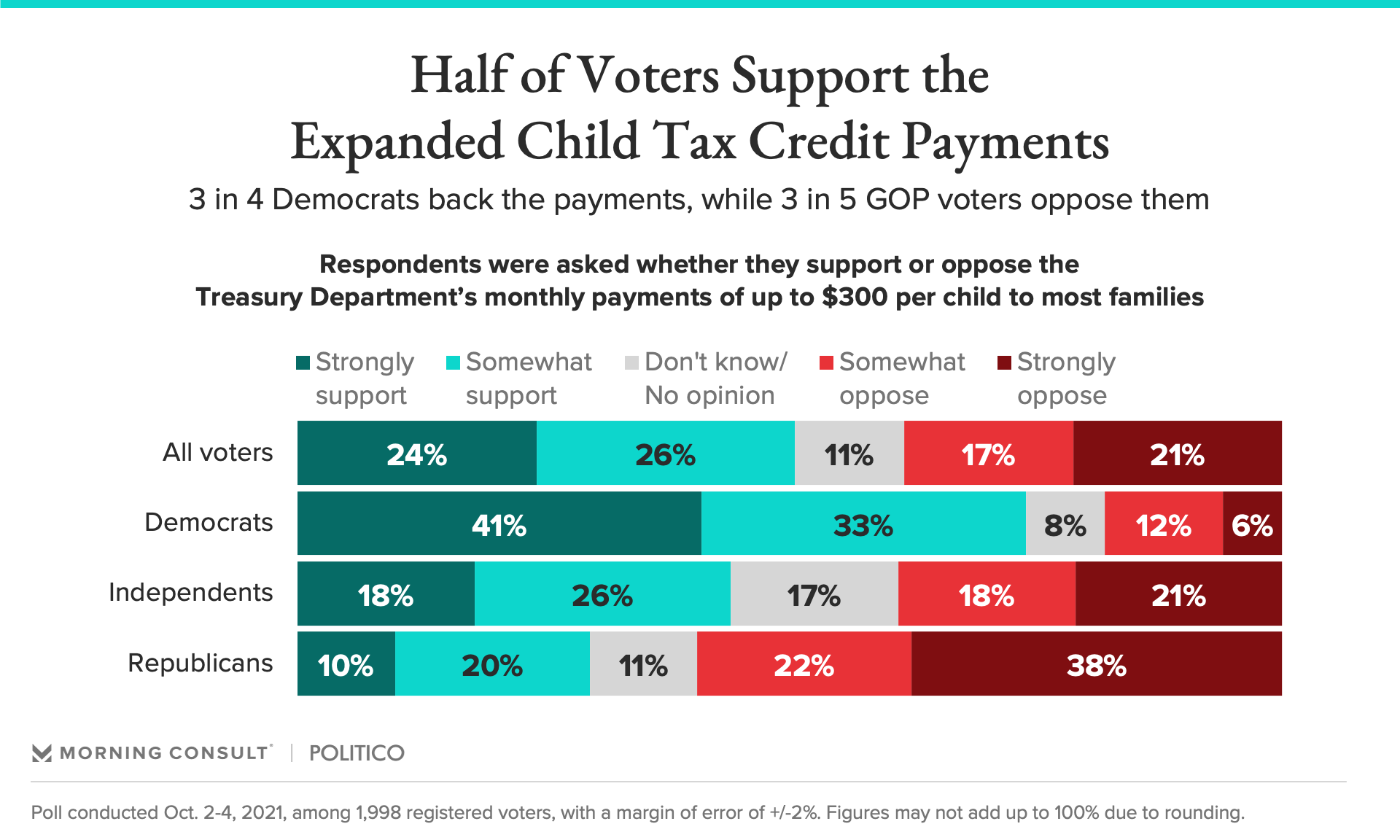

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Update Millions Of Americans Can Claim 2 000 Per Child Find Out Your Maximum Amount

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor